Thor Industries Inc (THO) is a $5.1B automobile stock that designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Canada, and Europe.

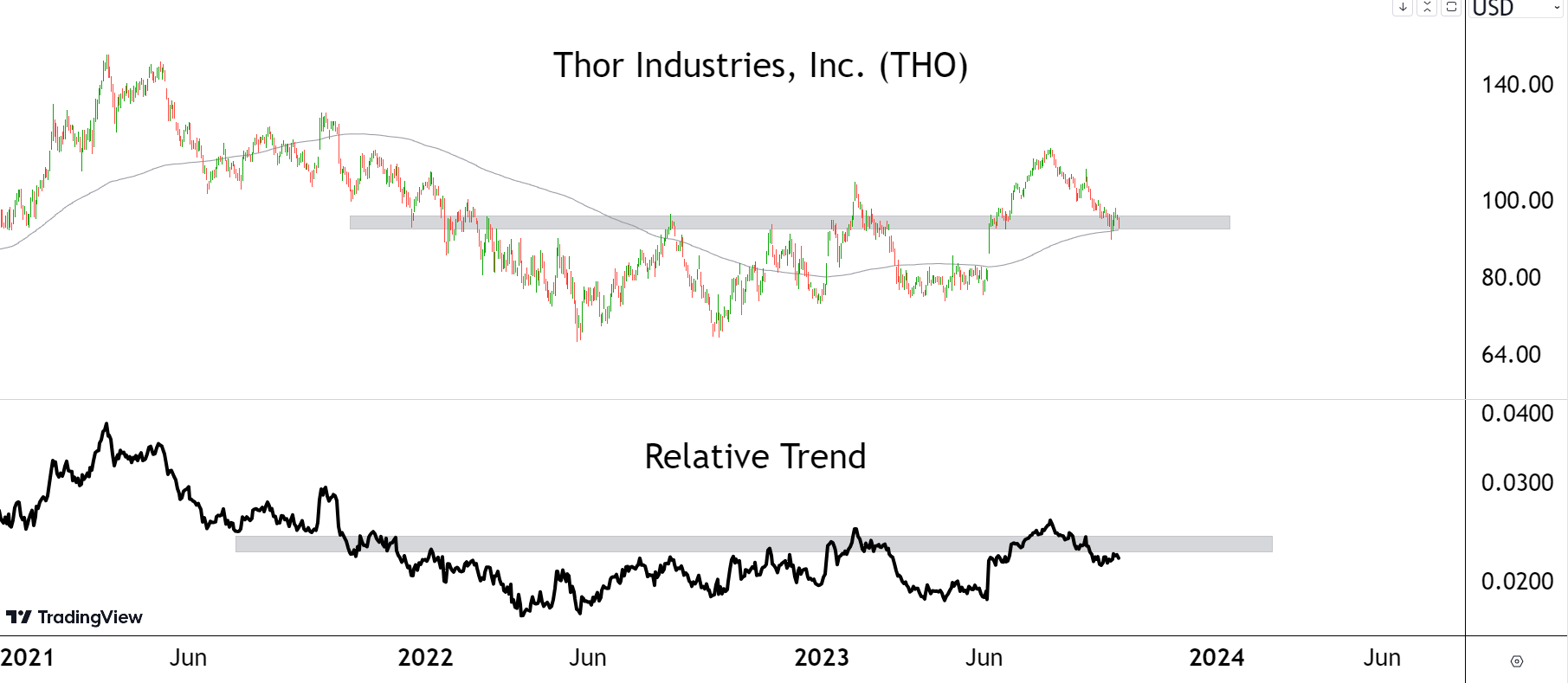

Like most of the broader market, THO finds itself in a noticeable drawdown from its all-time highs achieved in 2021. But in recent quarters, the stock has been attempting a recovery, breaking out of a basing pattern.

Looking over the short-term, THO has retracted its breakout rally and is retesting a shelf of former resistance.

The technical principle of polarity suggests that when resistance is broken, it flips to support on a retest. Should THO hold this retest of 94, the bias is higher for this stock.

For more technical analysis sign up for the FREE Chart Of The Day.

Recent Posts

Technical Analysis of Gap Inc.

Gap Inc. is a leading global retailer that offers clothing, accessories, and personal care products for men, women, and children. With a portfolio of well-known brands including Gap, Old Navy, Banana Republic, and Athleta, Gap Inc.

Technical Analysis of CCC Intelligent Solutions

CCC Intelligent Solutions Holdings, Inc. is a provider of innovative cloud, mobile, telematics, hyperscale technologies, and applications for the property and casualty (“P&C”) insurance economy.

Technical Analysis of Dick's Sporting Goods Inc.

Dick's Sporting Goods Inc. is a leading sporting goods retailer that offers a wide range of athletic apparel, footwear, equipment, and accessories.

Technical Analysis of Credo Technology Group Holdings

Credo Technology Group Holding Ltd. engages in the development of connectivity solutions and products for the data infrastructure market.

Technical Analysis of HP Inc.

HP Inc. is a leading technology company that specializes in providing a wide range of products and solutions for personal computing, printing, and imaging. With a strong presence in the global market, HP Inc.